Feature Spotlight: Fee & Expense Tracking

How do Appraisal Inbox Fee & Expense Tracking work?

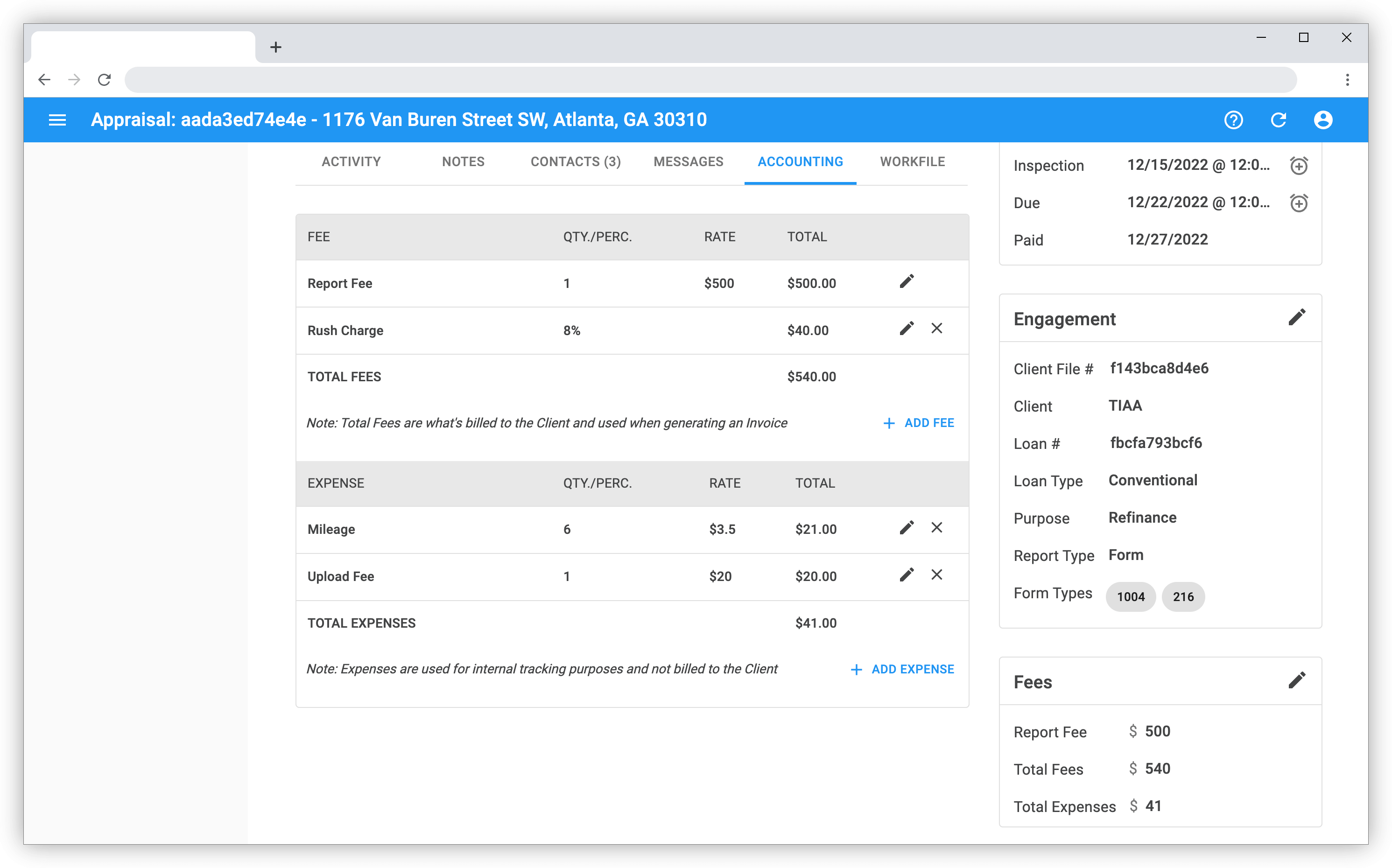

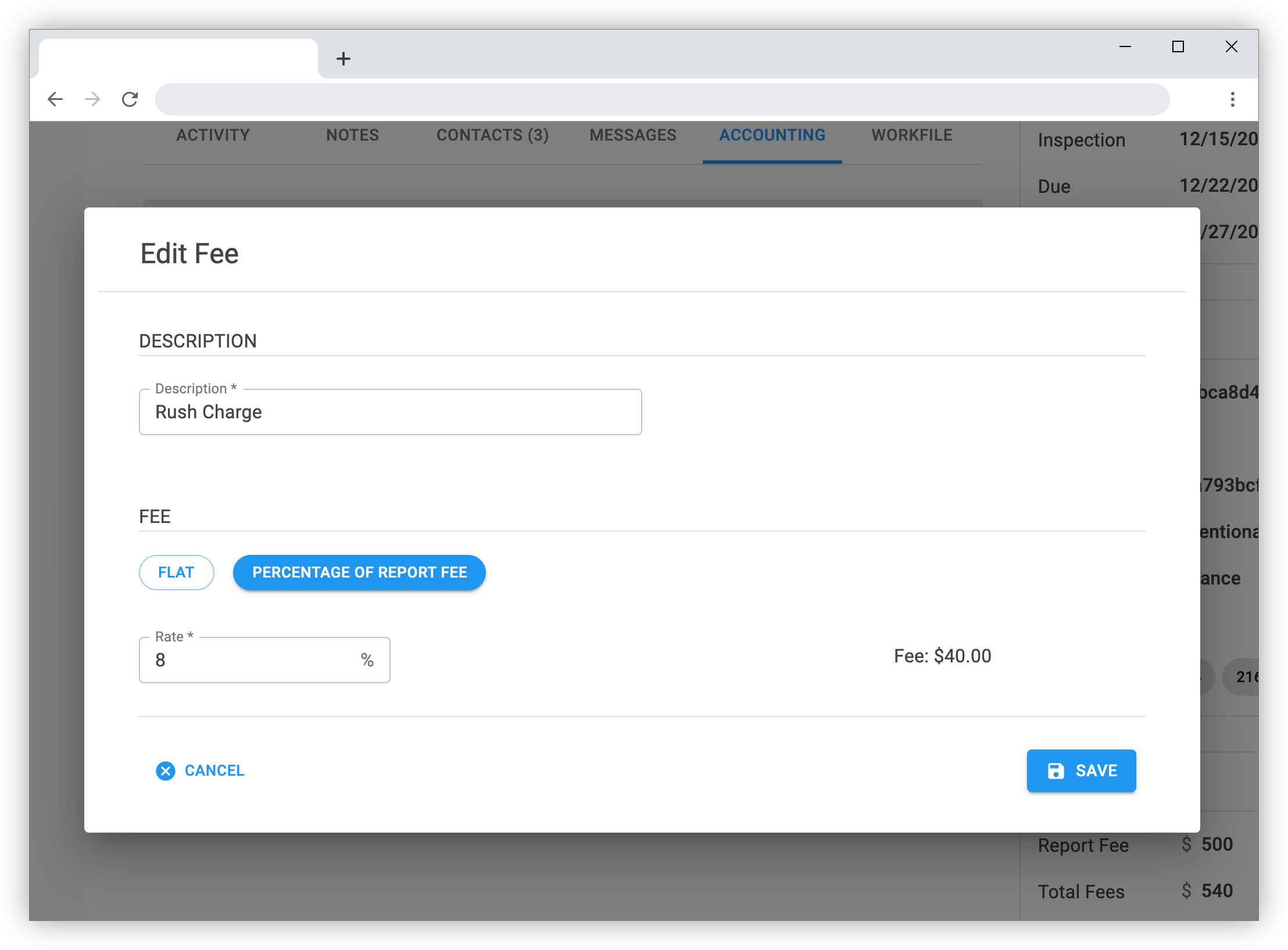

A typical appraisal assignment often has a number of fees and expenses which need to be tracked. For example, the order might have been engaged at a specific fee. But your client needs the order quicker than usual and is willing to pay an 8% rush charge. Additionally, you may need to track mileage for tax purposes as well as record the client’s “upload charge” for internal record keeping.

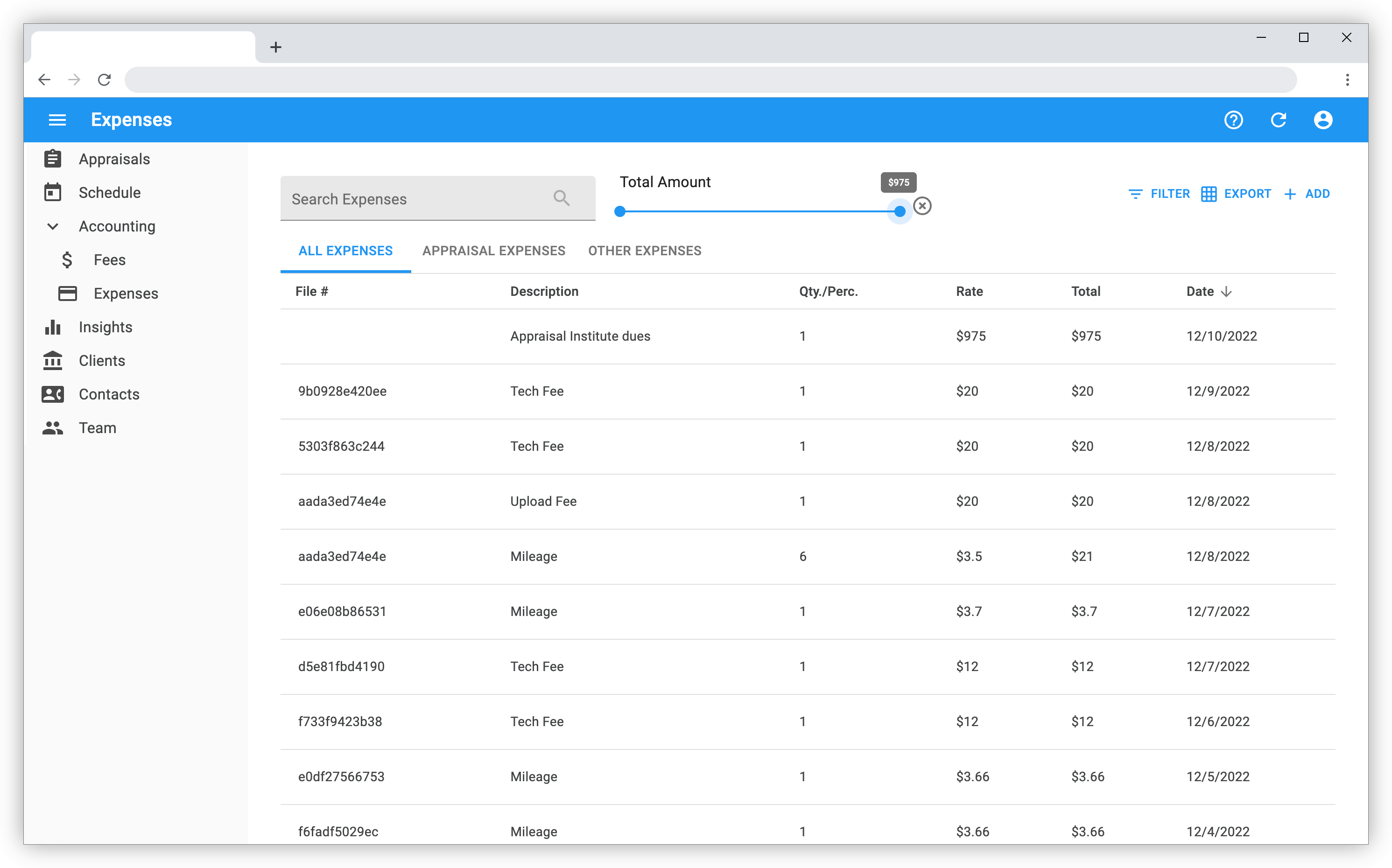

Appraisal Inbox makes tracking these various fees and expenses simple for appraisers. You can track one or more fees (which can be a flat fee multiplied by quantity - or - a percentage of the report fee). Fees are automatically summed up for purposes of billing your client. And for internal accounting purposes, you can track your business expenses (either on a per-appraisal basis or stand-alone).

Recent Posts

Feature Spotlight: File Number Configuration

Discover how Appraisal Inbox's File Number Configuration automates consistent file numbering for app...

Read moreFeature Spotlight: Two-Way Sync for Google & Outlook Calendars

Sync appraisal schedules automatically between Appraisal Inbox, Google Calendar, and Microsoft Outlo...

Read moreFeature Spotlight: Portal Push

Discover how Portal Push eliminates manual data entry, saving appraisers hours of time with one-clic...

Read more